Allianz Global Assistance’s Annual Vacation Confidence Index Reveals That Over-Spending Americans Go Over Budget by $534, and Vacation Spending Has Increased Over $20 Billion Since 2010

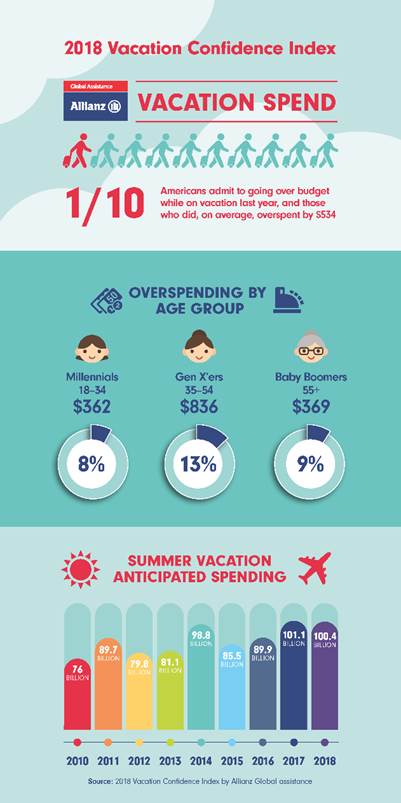

Richmond, VA, July 24, 2018 – With its tenth annual Vacation Confidence Index*, Allianz Global Assistance finds 10 percent of Americans admit to going over budget while on vacation last year, and those who did, on average, overspent by 27 percent ($534).

Breaking down by age group, 92 percent of Millennials (ages 18-34) and 91 percent of Baby Boomers (ages 55+) did not overspend, while 87 percent of Gen X’ers (ages 35-54) were able to stay within budget. Gen X’ers also tend to overspend more, averaging 32 percent over budget, which amounts to $836 based on their anticipated spend, while Millennials overspent by 26 percent ($362) and Baby Boomers overspent by 20 percent ($369).

The 2018 survey reveals that the average anticipated spend on vacations this summer, $1,936, has decreased slightly from last year, when it was $1,978. Still, the projected total spend will crack the $100 billion mark for the second time in the survey’s history, amounting to $100,400,000,000.

| Vacation Confidence Index 2018 | ||||

| Year | Projected Total Spend | % Change | Average Spend | % Change |

| 2010 | $76 Billion | N/A | $1,653 | N/A |

| 2011 | $89.7 Billion | 18 | $1,704 | 3.1 |

| 2012 | $79.8 Billion | -11 | $1,565 | -8.1 |

| 2013 | $81.1 Billion | 1.6 | $1,755 | 12.1 |

| 2014 | $98.8 Billion | 21.8 | $1,895 | 7.9 |

| 2015 | $85.5 Billion | -13.5 | $1,621 | -14.4 |

| 2016 | $89.9 Billion | 5.1 | $1,798 | 10.9 |

| 2017 | $101.1 Billion | 12.5 | $1,978 | 10.0 |

| 2018 | $100.4 Billion | -0.7 | $1,936 | -2.1 |

Allianz has analyzed American travelers’ summer vacation spending habits, revealing that Americans are forecasted to spend over 20 percent (23.5 percent) more than they did in 2010, when the average anticipated spend was $1,653.

The survey also shows that 46 percent of Americans typically take an annual summer vacation, a three percent decrease from 2017, while 53 percent do not. However, 18 percent of Americans have taken a vacation in the past three months, up four percent in 2017, which may explain both the decrease in those taking a summer vacation and the decrease in spend.

Despite a slight decrease in spend in 2018, Americans are still projected to spend significantly more on summer vacation than 2016, when the total spend was $89,900,000,000. The total spend continues to rise overall, mirroring the Dow Jones Industrial Average (DJIA) growth since recovering from the recession of 2008 – 2009. Since the beginning of 2012 to the start of this year, the DIJA has doubled, increasing from 12,360 to 25,075[1]. The DJIA sat at nearly 20,000 at the start of 2017, when the projected spend hit $101,100,000,000. Stock market ups and downs in the first few months of 2018 may have impacted this year’s lower total spend, decreasing less than a percent (0.7 percent)[2].

“Traveling is an investment, and one that has been increasing over the last ten years, as our Vacation Confidence Index shows,” said Daniel Durazo, director of communications at Allianz Global Assistance USA. “While other variables – the stock market, airline ticket price, gas, hotel rates – change, it’s safe to say that people continue to find value in and spend money on travel. Travelers may be able to protect many travel investments with the right travel insurance policy.”

The Vacation Confidence Index has been conducted each summer since 2009 by national polling firm Ipsos Public Affairs on behalf of Allianz Global Assistance USA. A vacation is defined as a leisure trip of at least a week to a place that is 100 miles or more from home.

Allianz Global Assistance offers travel insurance** through most major U.S. airlines, leading travel agents, online travel agencies, other travel suppliers and directly to consumers. For more information on Allianz Global Assistance and the policies offered for travelers, please visit: https://www.allianztravelinsurance.com.

*Methodology: These are findings of an Ipsos poll conducted on behalf of Allianz Global Assistance. For this survey, two methodologies were employed. First, a sample of 1,005 Americans from the Ipsos I-Say panel and non-panel sources was interviewed from May 2 –5, 2018.The precision of online polls is measured using a credibility interval. In this case, the weighted results are accurate to within +/-3.5 percentage points, 19 times out of 20, of what the results would have been had all American adults been polled. Second, a live-operator telephone survey was conducted via the ORC Caravan from May 31 to June 3, 2018, using random-digit dialing, including cellphone sampling. The margin of error is +/- 3.1 percentage points, 19 times out of 20.

Allianz Global Assistance USA

Allianz Global Assistance USA is a leading consumer specialty insurance and assistance provider with operation centers in 34 countries. In the United States, Allianz Global Assistance USA (AGA Service Company) provides insurance to 35 million customers and is best known for its Allianz Travel Insurance plans. In addition to travel insurance, Allianz Global Assistance USA offers tuition insurance, race registration protection, event ticket protection and unique assistance services such as international medical assistance and concierge services. The company also serves as an outsource provider for in-bound call center services and claims administration for property and casualty insurers and credit card companies.

To learn more about Allianz Travel Insurance plans, please visit allianztravelinsurance.com or Like us on Facebook at Facebook.com/AllianzTravelInsuranceUS.

**Terms, conditions, and exclusions apply to all plans. Plans are available only to U.S. residents. Not all plans are available in all jurisdictions. For a complete description of the coverage and benefit limits offered under your plan, carefully review your plan’s Letter of Confirmation/Declarations and Certificate of Insurance/Policy. Insurance coverage is underwritten by BCS Insurance Company (OH, Administrative Office: Oakbrook Terrace, IL), rated “A‐” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: Richmond, VA), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101‐C series or 101‐P series, or Nationwide Mutual Insurance Company and Affiliated Companies (One Nationwide Plaza, Columbus, OH 43215‐2200), under Form Nos. SRTC 2000 and NSHTC 2500, each rated “A+” (Superior) by A.M. Best Co., depending on state of residence. Allianz Travel Insurance products are distributed by Allianz Global Assistance, a brand of AGA Service Company or its affiliates. AGA Service Company is the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Noninsurance benefits/products are provided and serviced by AGA Service Company.