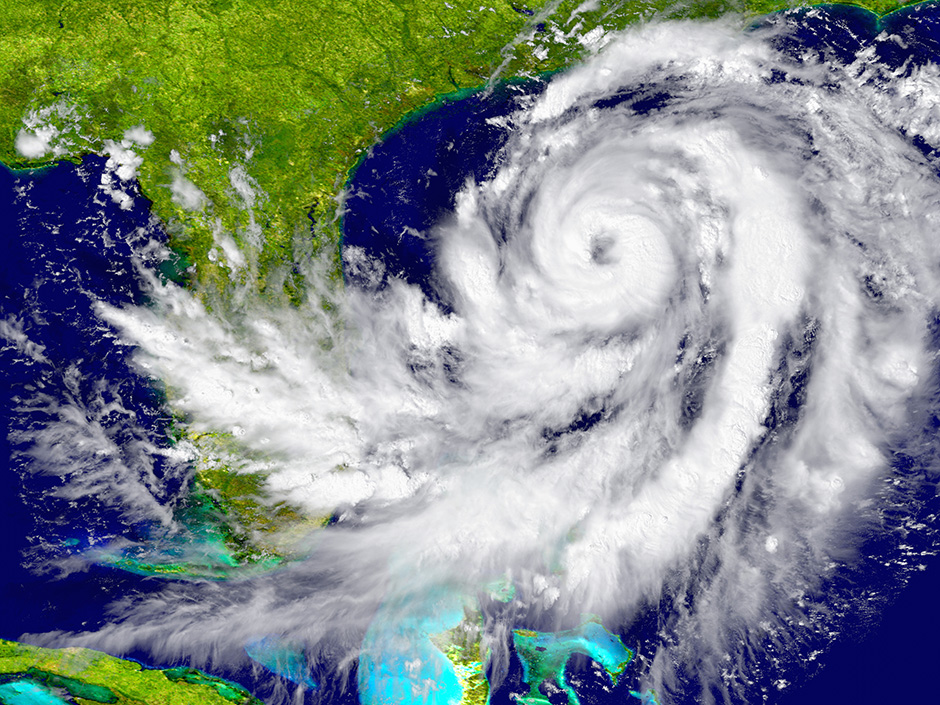

Travel insurance can cover travelers whose trips are impacted by a winter storm, as long as the policy is purchased before the storm is named. The World Meteorological Organization officially names hurricanes, therefore once a storm is publicized in the media as a named storm, it’s often too late to buy coverage for that storm.

This year, The Weather Channel projects the hurricane season will surpass the 30-year average, with up to 14 named storms, 3 of which are expected to become major hurricanes. For those with trips planned between June 1 and November 30, Squaremouth recommends purchasing travel insurance shortly after booking a trip to give travelers the best chance of coverage.

Travel Insurance Can Make Delays More Comfortable

Last year, roughly 35% of all delayed arrivals last year were due to weather, according to the U.S. Department of Transportation’s Bureau of Transportation Statistics. These weather-delayed arrivals totaled to 29 million minutes, the equivalent of just over 55 years of weather delays.

Travel Delay coverage can refund travelers for meals and hotels during their delay, and some can cover the additional costs a traveler incurs to catch up to their destination, or to return home. Most policies state a traveler must be delayed for 3 to 12 hours in order to be covered. If weather is a primary concern, travelers should look for a travel insurance policy with the shortest delay time required.

Travel Insurance Can Cover You if Your Home is Damaged by the Storm

Last year, high winds and flooding from major hurricanes Florence and Michael caused significant damage to homes in the southeastern U.S. If a hurricane makes landfall in a traveler’s hometown and severely damages their house, most Trip Cancellation-style policies can cover the cost for the traveler to cancel their trip, or return home early, as well as any unused expenses due to the early return. Some policies can also refund travelers if their place of work is rendered uninhabitable by the storm.