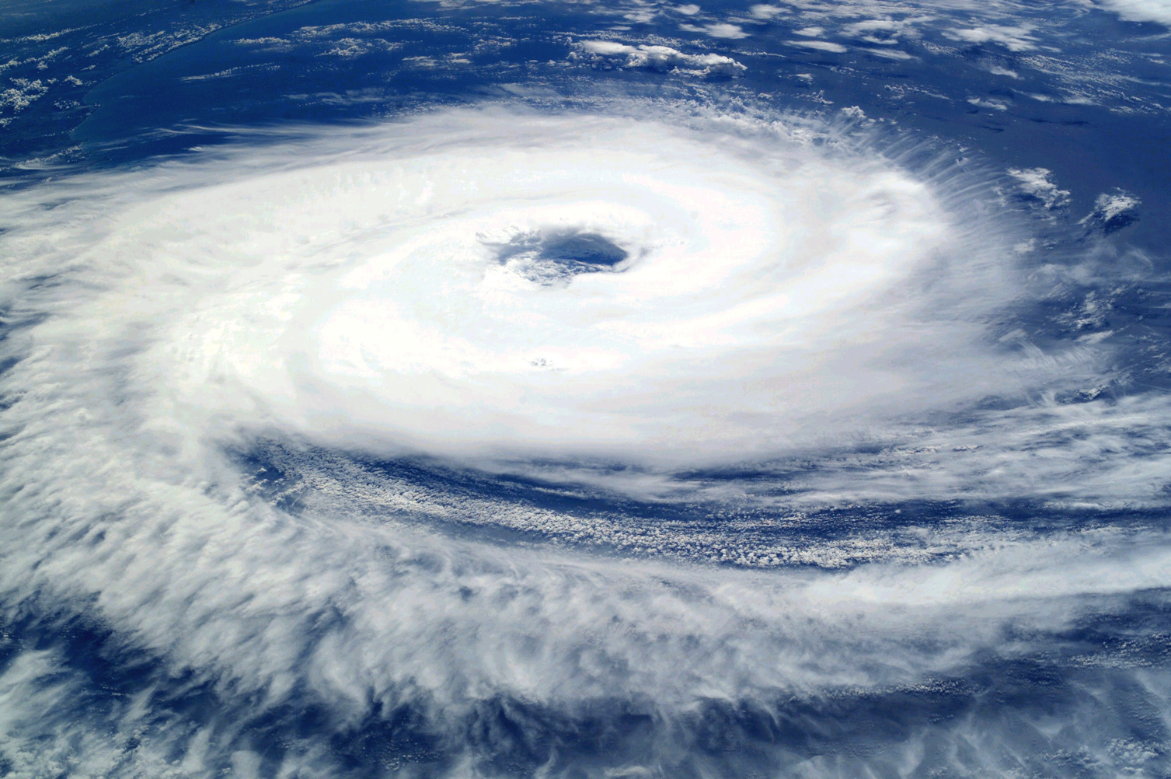

Experts at Squaremouth clarify what is — and isn’t — covered as Hurricane Melissa disrupts Caribbean travel plans

With Hurricane Melissa now a Category 5 storm threatening popular Caribbean destinations, travelers are seeking clarity on how their trips and insurance coverage may be affected. Travel experts at Squaremouth, a leading travel insurance comparison site, have shared insights into what travelers can expect — and what steps to take next.

Does travel insurance cover Hurricane Melissa?

Yes — but only if you purchased your policy before the storm was officially named. Travel insurance is designed to cover unforeseen events, meaning that once a storm is named, any policies purchased after that point will not cover related disruptions.

As of October 21, it became too late to buy travel insurance that includes coverage for Hurricane Melissa. While travelers can still purchase policies after a storm is named, any claims related to that specific storm will be denied.

Squaremouth advises travelers to always buy insurance as soon as they make their first trip deposit, particularly if traveling to regions prone to hurricanes or severe weather.

If I purchased travel insurance before Melissa was named, what’s covered?

Travel insurance can reimburse travelers for prepaid, non-refundable expenses if a trip is canceled or disrupted due to the hurricane. Covered scenarios include:

- Your destination becomes uninhabitable due to storm damage

- Your destination is inaccessible because of the hurricane

- Your airline or cruise line cancels your trip due to the storm

- A hurricane warning or mandatory evacuation is issued at your destination

- Your home sustains direct damage from the hurricane

Most travel insurance plans will reimburse up to 100% of your covered, prepaid costs — including flights, cruises, hotels, and tours — as long as you provide receipts and documentation when filing a claim.

What should I do if my travel plans are affected?

- Contact your travel insurance provider immediately to confirm what’s covered.

- If you don’t have insurance, reach out to your airline, cruise line, or hotel for possible waivers or credits.

- For future trips, purchase travel insurance early — before a storm is named — to ensure full protection.

Will travel insurance cover my cruise during Hurricane Melissa?

Yes, if the policy was purchased before the storm was named. Coverage typically includes prepaid and non-refundable cruise expenses, as well as nearby hotel stays and excursions booked in advance.

Important reminder: what travel insurance doesn’t cover

A common misconception is that travelers can cancel their trip simply because a hurricane threatens or disrupts the region. If your hotel or resort remains open and operational, your cancellation may not be covered — even if the weather impacts your plans.

For travelers seeking maximum flexibility, Cancel For Any Reason (CFAR) add-ons can allow cancellation for non-covered reasons, such as concerns over weather or itinerary changes.

For additional guidance on hurricane-related coverage, visit Squaremouth’s hurricane and weather insurance resource page.